Selling Your Property

Fair Market Value

We will go through a process of discovery together to determine the fair market value of your home. The Comparative Market Analysis (CMA) will serve as a barometer of current market conditions and provide information on a variety of factors which will help us price your property for a successful sale.

We will go through a process of discovery together to determine the fair market value of your home. The Comparative Market Analysis (CMA) will serve as a barometer of current market conditions and provide information on a variety of factors which will help us price your property for a successful sale.

“Market Value” is the highest price at which a property will sell on the open market, given a reasonable time period to find a qualified buyer. The buyer purchases the home with complete understanding and knowledge of the property, with neither buyer or seller being compelled to act under abnormal pressure. A property is “worth” what a buyer is willing to pay for it, which determines what is known as its “Fair Market Value.”

The value of your home is based on the following criteria:

- Location of Property

- Condition of Property

- Buyer Demand

- Prices of similar properties on the market

- Recent sales of competitive properties

- Availability of financing

This information is evaluated for the purpose of forming an opinion of the Fair Market Value of your home under the prevailing conditions at the time of this proposal.

The following are the key factors which will affect the sale of your home:

| Market Factors: | Controlled by: |

| Price | Seller |

| Terms | Seller |

| Condition | Seller |

| Marketing Program | REALTOR® / Real Estate Company |

| Value | Buyer / Market Conditions |

Opinion of Value

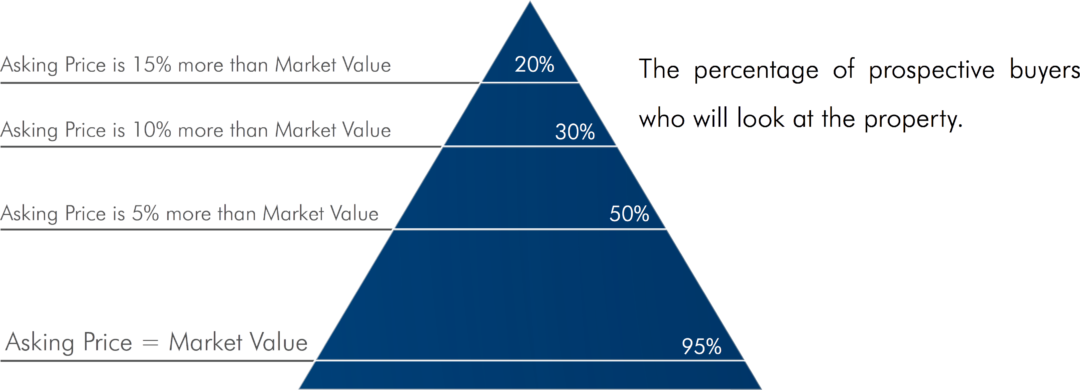

The single most important factor in the marketing of real estate is the opinion of value. Property priced too high will sit on the market and become “shop worn.” Ideally, the property should be priced at Comparable Market Value. Studies continue to show that a property listed at 15% over market value has a 20% probability of sale; 10% over market value has a 30% probability of sale; 5% over market value has a 50% probability of sale. Properties priced at market value have a 95% probability of sale.

The method most often used in evaluating single family homes is the Comparable Method. A property is worth what the buyer is willing to pay for it and this is determined by the basic laws of supply and demand. These two factors are evaluated by comparing the home with similar homes that have sold within the market area, with appropriate consideration given to location, amenities, lot size, condition, and financing terms. The resulting range is known as the Comparable Market Value of the subject property:

Window of Opportunity

Window of Opportunity

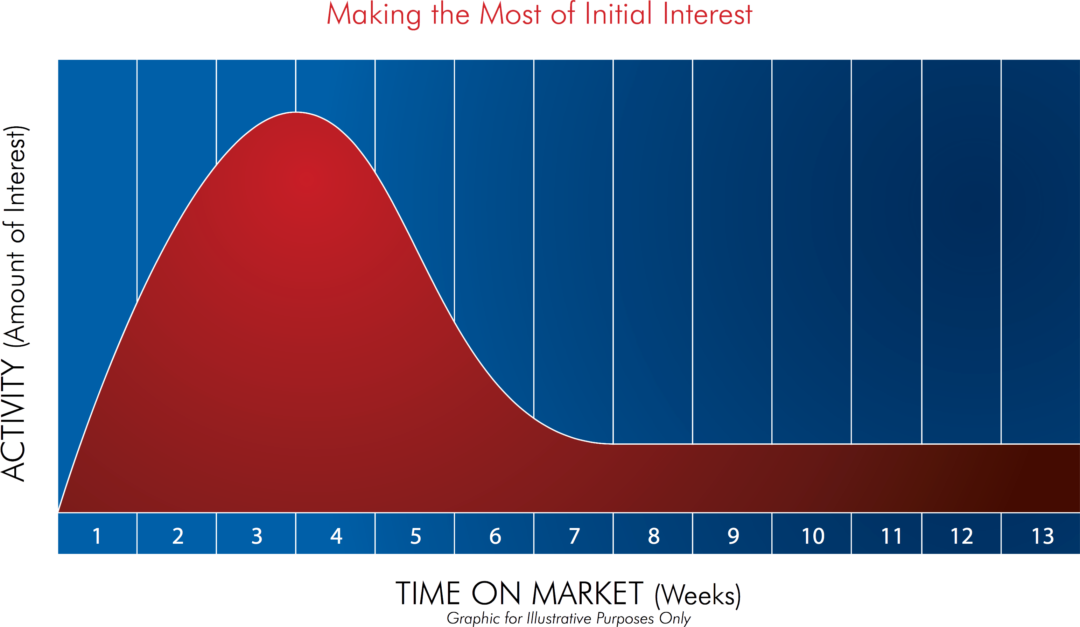

Sellers often make the mistake of wanting to price their homes high at the start, with the assumption that they can always reduce the price to a more realistic level later. However, interest peaks when your home is new on the market and drops off dramatically as time goes on.

Finalizing the Sale

Finalizing the Sale

A myriad of details must be attended to before a sale becomes final, including inspections, loan documents, contingency removals, insurance, and escrow items. I will follow through on all of these matters to keep the process proceeding on schedule and destined for a successful close.